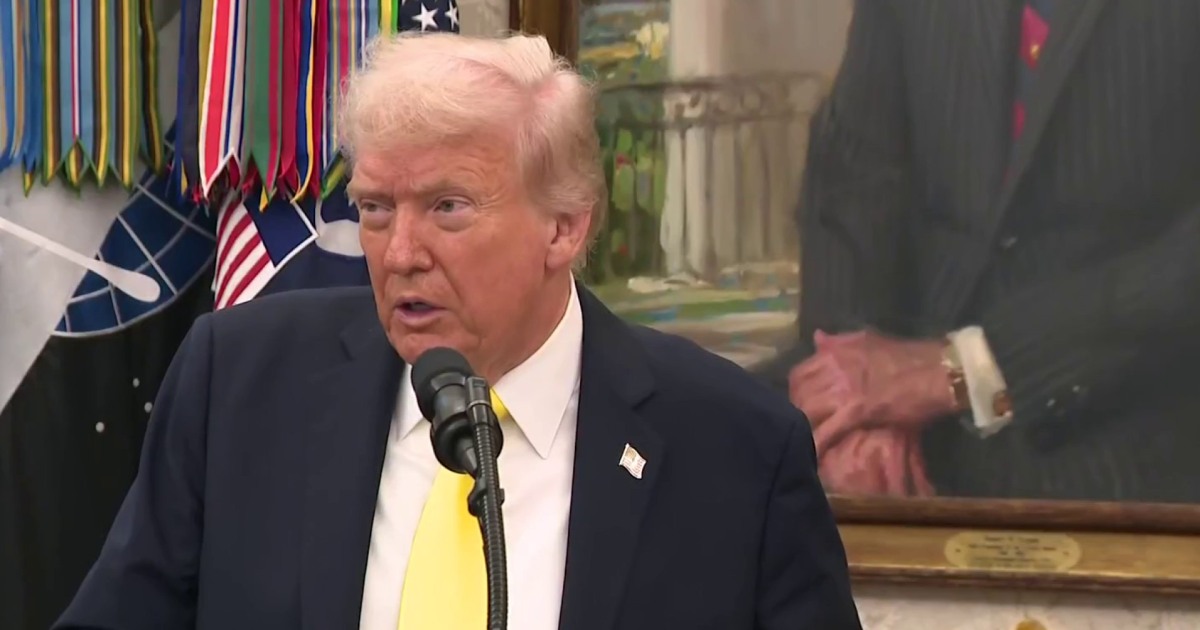

The U.S. military carried out a strike against an alleged Venezuelan drug cartel boat in the Caribbean Sea and there were survivors, according to a U.S. official.

Source link

U.S. strikes suspected Venezuelan cartel boat

The U.S. military carried out a strike against an alleged Venezuelan drug cartel boat in the Caribbean Sea and there were survivors, according to a U.S. official.

Source link