Sen. Adam Schiff, D-Calif., presses Attorney General Pam Bondi on a list of topics she refused to discuss during the Senate Judiciary Committee’s oversight hearing, including bribery allegations against Tom Homan, the prosecution of former FBI Director James Comey, and the Epstein investigation.

Source link

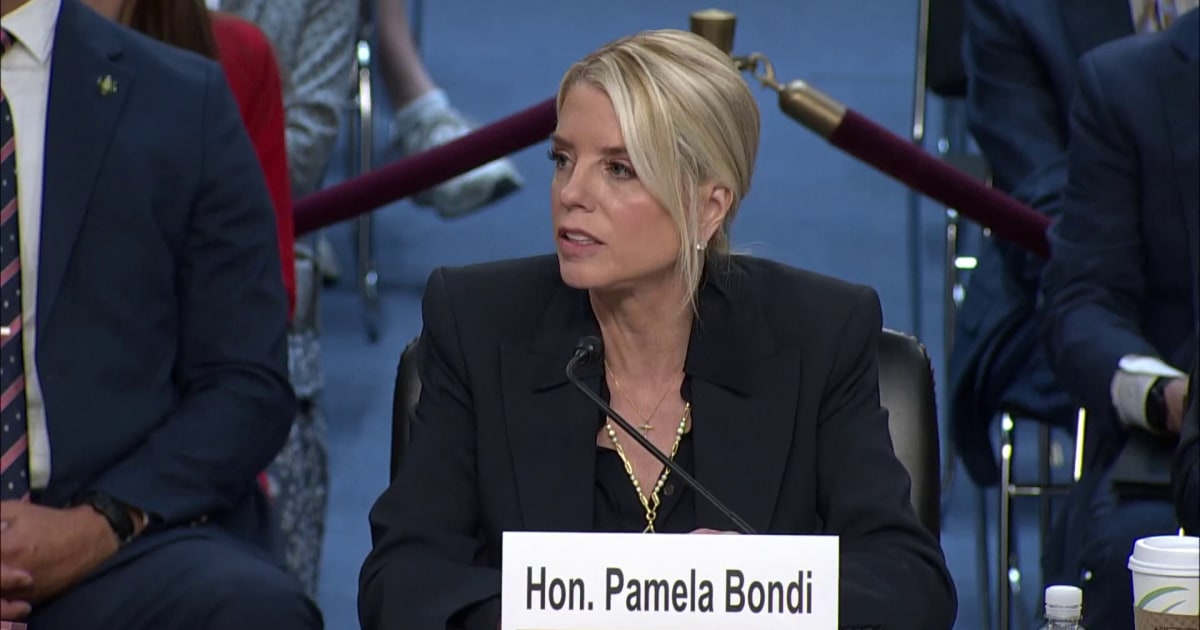

Schiff recaps questions Bondi refused to answer during oversight hearing